By Alysha A. Cunningham

What do Tesla and Meta have in common? One manufactures electric vehicles, the other operates social media platforms. Yet economically, their connection is closer than it appears.

Social media’s influence on financial markets has connected the economy in unpredictable ways. Tweets from users with little to no expertise in finance have proven to have a ripple effect on the stock value of unrelated companies. When the Tesla stock drops, so does Meta’s — along with 200 other firms.

This relationship between social media discussions and finance is what Carleton University researcher Mohamed Al Guindy has coined the Social Internetwork.

Carleton University researcher Mohamed Al Guindy

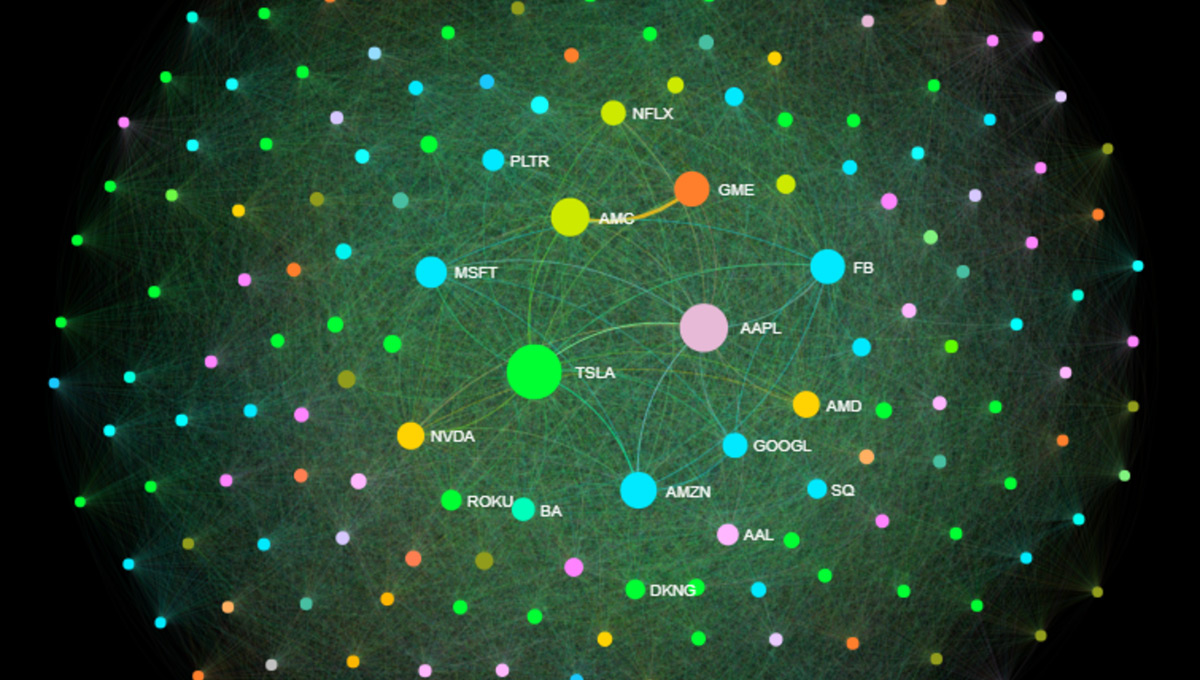

Using artificial intelligence (AI) to analyze hundreds of millions of financial tweets regarding publicly traded companies, Al Guindy has mapped out a new nexus of the economy that illustrates which companies’ financial worth are connected, simply based on social media discussion.

The result? A tool that investors, regulators and governments can use to help predict economic shocks, as well as predetermine the impact of intervention efforts and market manipulation.

“With this tool we can see that the average firm is now financially connected to over 600 other companies,” says Al Guindy, assistant professor of finance and financial technology, or FinTech, expert with Carleton’s Sprott School of Business.

“That is 600 companies that can be affected by as little as one tweet.”

Social Media’s Influence & the Power of Public Perception

What is novel is that these economic connections are not established by the companies themselves, but instead through public perception. The companies may not be in the same market or share manufactures or suppliers — instead their connection is determined by what Al Guindy describes as the “wisdom of the crowd.”

In comparison, previous studies have limited the number of economic connections for a company to a mere dozen or so — excluding industry links. Now with social media’s influence, Tesla and Meta have more in common than Tesla and another auto manufacturer like Ford.

“These issues are important to the understanding of financial crises as well as the understanding of shocks to the economy,” says Al Guindy.

His research also sheds light on how financial shocks spread in the economy, and which companies are most influential. This information provides crucial context for policymakers when planning economic intervention programs.

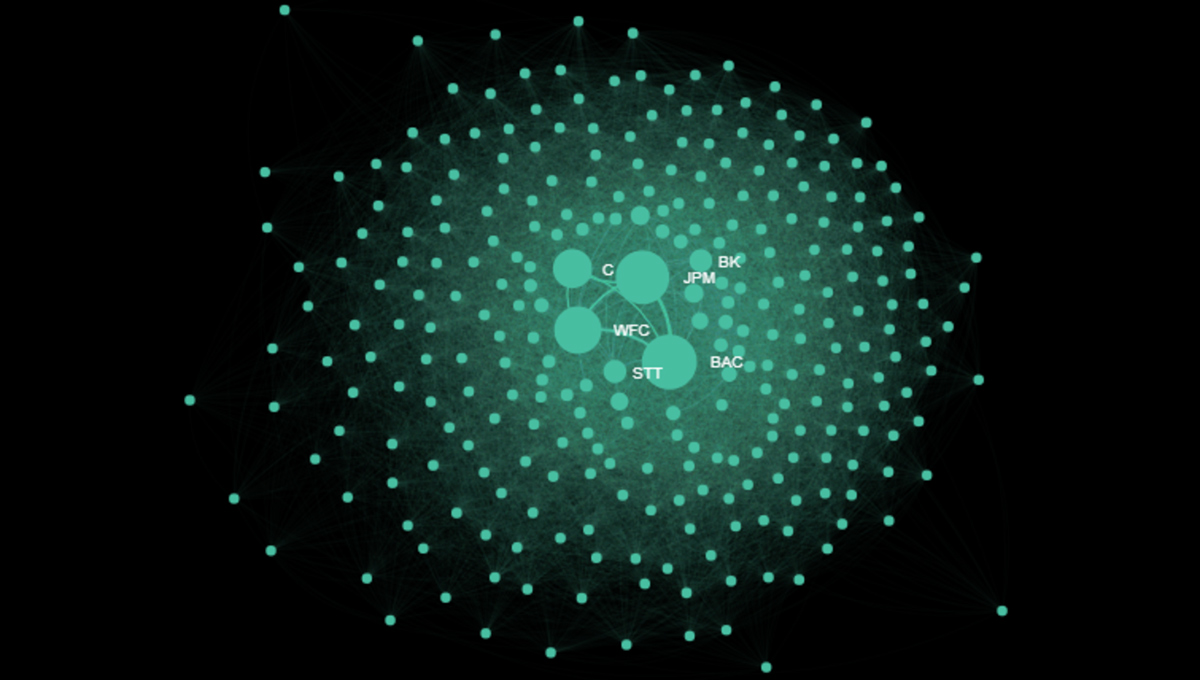

A network diagram from the Social Internetwork showing the connections in the banking industry

“We’re looking at more intricate relationships and connections within the economy,” explains Al Guindy.

“We also know the strength of the connections; not all are equal, and some are stronger than others. All of this is captured in the network in ways that were not possible before.”

By examining tweets about the most central and prosperous firms, the Social Internetwork has uncovered that 92 per cent of the economy is connected indirectly. A single incident in one industry can trigger a ripple effect that spreads across seemingly unrelated sectors.

“These other connections matter as much as industry connections, or even more so,” says Al Guindy.

The network also illustrates how when a central company is doing poorly, it trickles down to the rest of the economy and is essentially mirrored. But the reverse is not true — what happens on the periphery doesn’t affect the centre.

“This leads our knowledge in terms of financial networks,” says Al Guindy.

“We know that financial networks are important but now we are able to construct something that is a lot deeper, a lot denser using the wisdom of the crowd.”

Using this approach also ensures that the network representation captures the various economic connections among companies as seen by investors. These networks evolve over time and rapidly change in response to financial and economic changes.

Dynamic Insights into the Nature of Financial Networks

In response to the fluctuating nature of the economy, Al Guindy is working towards making the data available in real time through Carleton’s new Social Media & Finance AI Lab, which will be opening this summer. Both the lab and the ability to analyze tweets in real time will provide valuable insights into the dynamic and ever-changing nature of financial networks.

“We want to look at dynamic networks in order to see movement, not just a static picture,” explains Al Guindy.

“The goal is to construct dynamic and time varying networks of the economy.”

Currently it takes a month to generate the static network for one year of data. The new lab will bring in tremendous computing power with the ability to analyze tweets on a daily basis — a first in Canada.

“This work is not only ground-breaking, but it also positions Carleton as a global leader in the space of social media finance,” says Al Guindy.

Thursday, March 23, 2023 in Innovation, Research, Sprott School of Business, Technology

Share: Twitter, Facebook